Click Below to Visit a Dedicated Site For Each Provider

Frequently Asked Questions

Why Do I Need Funeral Cover?

Funeral cover makes sure that you or your family have money available if you or an insured family member passes away. The difference between generic life insurance and funeral cover is you will have money available swiftly. Most providers promise your cash payout under 48 hours. This is obviously subject to receiving the required documents. Some funeral cover providers make payments as soon as 6 hours after submission.

This will assist you or your family financial in a very sensitive time. Arranging a funeral can be extremely expensive. Not having funeral cover can force your family to pay for the funeral out of their own pockets. Much like car insurance, funeral cover is an essential product that should be taken very seriously. Read More

Who Can I Cover Under My Policy?

- Spouse (Girlfriend or Boyfriend)

- Children

- Parents

- Extended Family

- Grand Parents

- Employees

- Domestic Worker

- Groups, Unions, Churches etc.

Who Needs Funeral Cover?

In desperate economic time, everybody in South-Africa should fit themselves with some sort of funeral insurance. Funeral cover is the responsible thing to do. We provide a policy for every age bracket. The younger generation can include family members on their policy. This means you can even include your parents and grandparents. You can cover your girlfriend or boyfriend, cousins, aunts uncles you name it. It’s always paramount to take out a funeral policy at a younger age. Read More

This way you can definitely ensure that you keep your monthly premium as low as possible. Some youngsters might claim that due to their health and current age they are less likely to die. This might be true, but accidents happen all the time. Death does not discriminate against age.

Why Do I Need Funeral Cover?

- Your Family Will Have Access to Funds Quickly

- Get Various Free & Optional Funeral Benefits

- Get Professional Funeral Services

- Your Family Will Not Incur Debt to Bury You

- Death Can Happen Unexpectedly

- Death is inevitable

- Reduce Family Trauma

- Peace of Mind

Do I Have to Undergo a Medical Examinations?

The answer is plain and simple. No. With most affordable funeral cover providers, you do not have to go for any medical examination. You don’t even have to answer any uncomfortable medical questions. All the funeral cover providers we represent guarantee your acceptance. They will issue your policy without you having to spend time at a local clinic. Funeral cover providers will usually give you the advantage.

There will, however, be a 6 month waiting period for natural causes. This simply ensures that you don’t take out a policy for a person that anticipate death. This is a basic industry standard and should not scare you at all. Remember, it’s always best to get funeral cover while you are healthy and strong. This will ensure that you are fully covered if you need it the most. Accidental death will usually be covered from the very first premium. Most providers offer additional accidental death benefits. This will help justify the 6 month period on natural causes.

Getting Funeral Cover Online

With Funeral Cover Me, you will not pay any extra fees or premiums. Our service is 100% free. We are owned and maintained by by InShoor™, a registered financial services provider # 43216. This means that we are authorised to represent the respective providers directly. This allows us to make this a free service. We do not provide your details to any third party companies. We arrange everything directly from our own offices.

What is the difference between getting funeral cover from a broker or online? It’s the absolute convenience of getting cover without hassle. We provide a national service. We can arrange your funeral cover without you ever having to leave your house. You can apply from a cabin in the woods; we will arrange your cover regardless. We have representatives that can visit you if you are in the Gauteng area. We can, however, arrange your funeral policy over the telephone.

We comply with the FSB rules and regulations. In the technology age, most people prefer to get funeral cover online. By getting this funeral cover online, you have the opportunity to study every provider in depth. With this knowledge, you make an informed decision. All the providers we represent are well established Read More

How Do I sign Up Today?

It’s very simple; you can sign up today for your funeral plan. All you need to do is complete our little form. A representative will call you back as soon as possible. If possible, we will visit you in person. If you are out of driving radius, we will arrange your funeral plan via our call centre. Getting affordable funeral cover has never been easier.

Available Funeral Cover Providers

At InShoor (PTY) Ltd. We represent some of South-Africa’s leading funeral cover providers. We have been awarded top AVBOB broker every year from 2012 – 2017. We have a passion for both our clients & funeral insurance. We currently represent, AVBOB, Metropolitan Life & Discovery Life.

We only represent companies who have proven themselves in the industry and provide solid products and services. We have a long standing relationship with every provider we represent. We are willing to stake our reputation on every listed provider.

Below are some basics about each provider. Feel free to visit our dedicated site by clicking on the banner above each provider.

AVBOB FUNERAL COVER – Get Up To R50 000 from just R46 p/m

AVBOB was established in Bloemfontein way back in 1921. They have since become one of the biggest providers in the industry. With AVBOB funeral cover, you will get a cash payout, and funeral arrangement service. This means that, with AVBOB, you will get your specified cash amount, and ample benefits. You can use your cash benefit to arrange the funeral yourself. Alternatively you can make use of them to arrange the funeral for you. By using AVBOB, you will receive many free benefits. This will ensure you can arrange the best imaginable funeral. AVBOB provides their clients with a cash back option every 60 months, provided no claim was made. AVBOB will payback 1 years premiums in full every 5 years. With this promising provider, you know you will be fully taken care of in a time you need it most. Get Up To R50 000 cover.

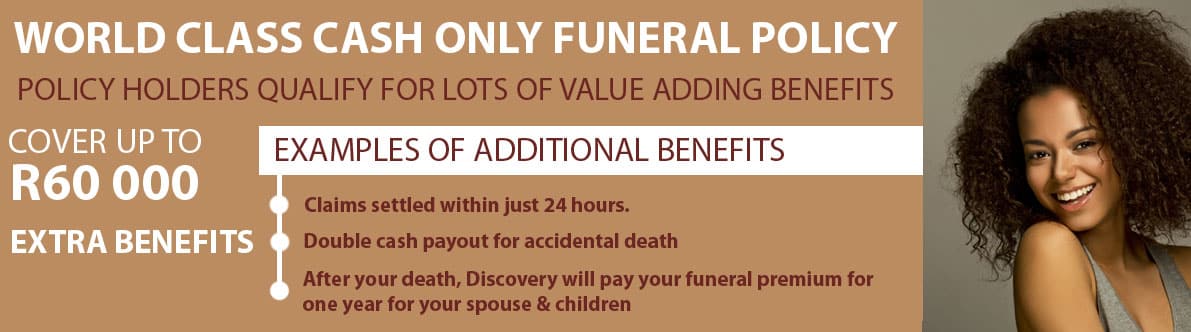

DISCOVERY FUNERAL COVER – Up to R60 000 from Just R48 p/m

Discovery Life is a cash only benefit with great policy benefits. As you would expect, with Discovery Funeral Cover, you will receive innovative benefits. They provide an optional Education, Grocery and other top notch benefits. There will be no medicals required. You don’t even have to answer any uncomfortable medical questions. With Discovery Life, you can have between R5000 and R60 000 cover. This is the highest cover amount we have on offer. There are interesting optional benefits available. This product does not insist any other Discovery Life products. With Discovery Life, you can rest assured that your funeral policy will be in good hands.

METROPOLITAN FUNERAL COVER – Up t R50 000 from Just R36 p/m

Metropolitan Life is a straight forward and to the point funeral insurance plan. They will provide you with a cash payout between R5000 and R50 000. Metropolitan will present you or your family with a cash payout within 48 hours. Provided you submit the relevant documents. Metropolitan funeral cover guarantees your acceptance. There will be no medical examinations required. They are a well-known, established benefits with a solid client base. You can cover yourself, family or employees under the Metropolitan Funeral plan.. With Metropolitan, you can have a maximum of R50 000 funeral cover.